The Potential Premium of Bitcoin Spot ETF in Cash Mode May Reach Up to 8%

GTS ETF’s Global Co-Head of Trading and Sales, Reggie Browne, stated on Bloomberg TV that due to the way US institutions currently handle cryptocurrencies, a Bitcoin spot ETF could potentially trade at a premium of up to 8%.

Table of Contents:

Toggle

Complexity of cash mode will lead to ETF premium

Physical mode will be the next stage

Canada’s BTCC also adopts cash mode

Browne believes that due to the complexity of the cash mode, many brokerage firms will need to hedge using futures, which could result in a premium for Bitcoin spot ETFs during the initial trading period. He estimates that the premium could be as high as 8%.

(

Illustration of ETF|Difference between SEC-preferred ETF cash mode and BlackRock’s physical Bitcoin ETF?

)

Advertisement – Continue reading below

However, he also believes that the market has enough liquidity to maintain a “very competitive and small” bid-ask spread for ETFs, as market makers are prepared to handle sufficient liquidity.

Browne expects that physical creation and redemption will become a reality at some point, although currently, they prove to be the sticking point during negotiations with the US Securities and Exchange Commission. Therefore, all companies currently awaiting approval for ETF applications have opted for a pure cash mode.

He stated:

This is to keep moving forward, and after climbing a few more mountains, the physical mode will be realized.

(

Bitcoin spot ETF update: Seek cash mode approval first, then strive for physical mode?

)

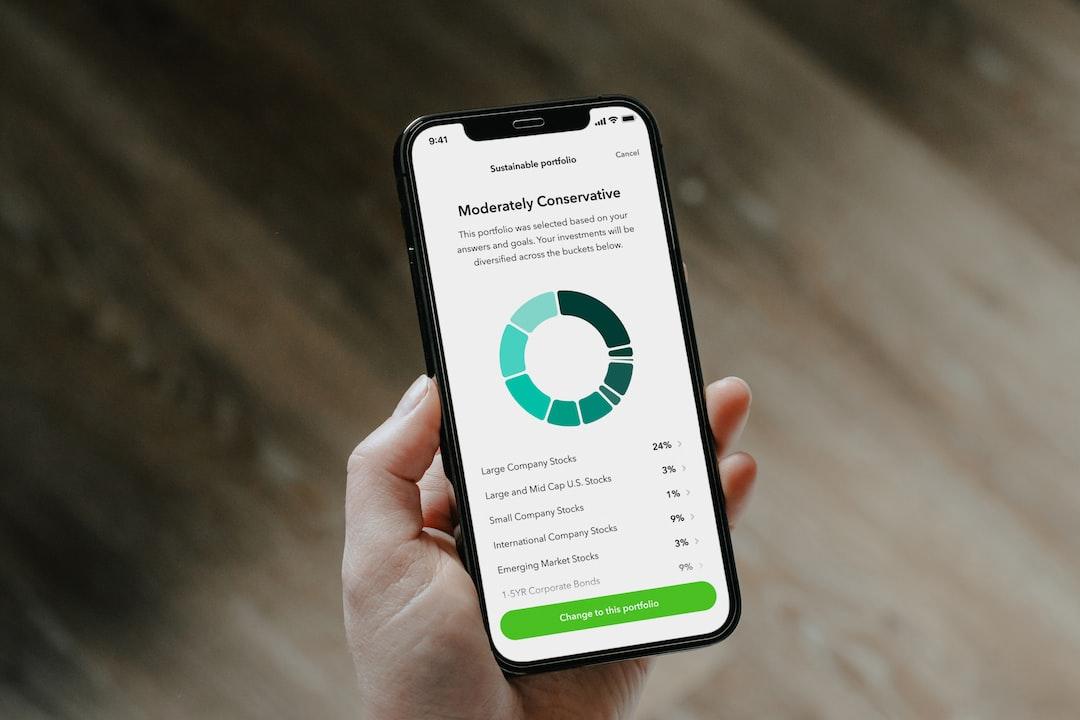

However, Bloomberg ETF analyst Eric Balchunas pointed out that the Canadian Bitcoin spot ETF BTCC also adopts the cash mode, but its premium is not significant, although occasionally there is a 2% discount or premium. He exclaimed that 8% is truly an astonishing number!

BTCC

BTCC is a Bitcoin spot ETF launched on the Toronto Stock Exchange in February 2021 by Canadian asset management company Purpose Investments Inc. It has an annual management fee of 1% and currently has assets under management of $2.22 billion, holding a total of 35,521 Bitcoins.

btcc

Reggie Browne

Bitcoin spot ETF

Further reading

12-year-old exchange BTCC’s first offline event in Taiwan: Valuing the Taiwanese market

BTCC launches new trading pairs on a large scale and will reward users with airdrops.