Enter the Next Phase: Essential Projects to Know Before the Arrival of AVS Wave, EigenLayer

Eigenlayer enters the next growth phase – the upcoming explosion of AVS

$EIGEN is now online, but there is a feeling of a burst bubble caused by speculation. However, we can’t help but study the new things. Besides Eigenlayer’s official introduction of a new concept – inter subjective forking, few people have studied the recently launched AVS and what teams are involved. What are the possibilities for the future?

Advertisement – Continue scrolling for more content

Many people have questioned the future development of Ethereum, but the author believes that we are just beginning a new phase with the launch of “eigenlayer mainnet”. After all, the majority of people in the market analyze the future based on price. We have experienced this during Solana’s low period in the past. Of course, the current price of ETH is dismal, breaking through the 3000 support level. However, this is an even better time to do our homework.

Table of Contents

Toggle

A brief review of the growth data of the past restaking track

Introduction to AVS (Actively Validated Services)

Eigen DA (Staked amount: 2.7 million ETH):

Eoracle Network (Staked amount: 1.87 million ETH):

Witness Chain (Staked amount: 1.82 million ETH):

Lagrange (Staked amount: 1.59 million ETH):

Brevis (Staked amount: 1.38 million ETH):

Alt_layer (Staked amount: 1.3 million ETH):

Omni Network (Staked amount: 1.28 million ETH):

XterioGames (Staked amount: 1.27 million ETH):

Automata Network (Staked amount: 870,000 ETH):

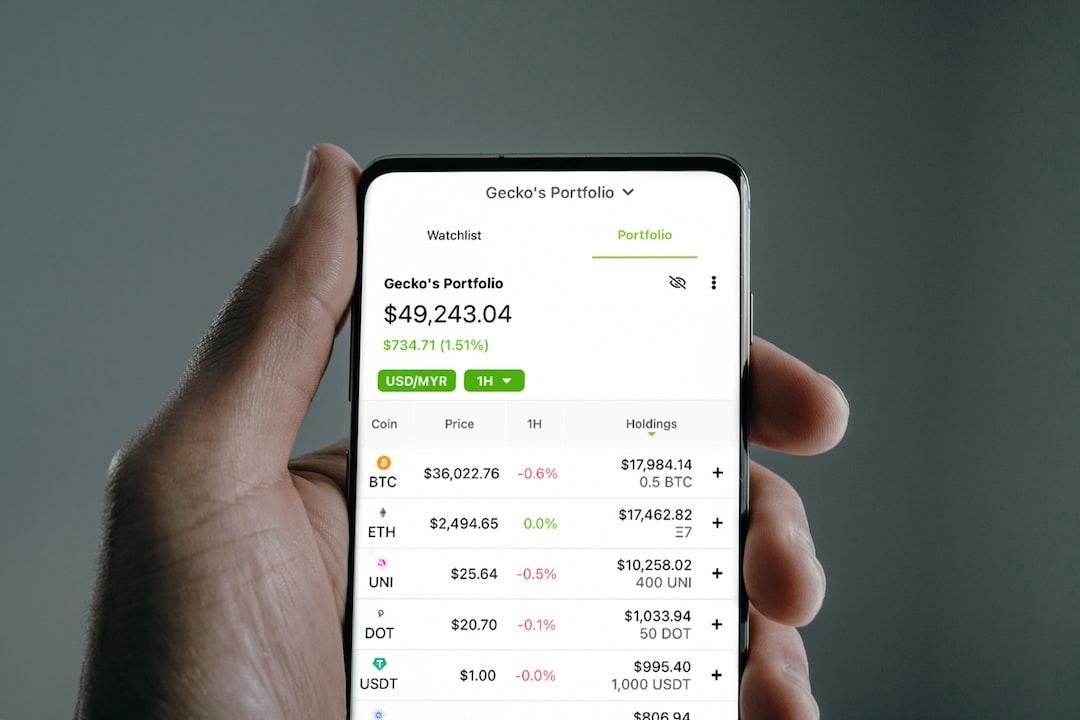

Eigenlayer’s restaking ecosystem approaches a TVL of nearly $16 billion

Compared to December, the current liquid restaking track has reached $10 billion according to DeFillama’s calculation, and Ethefi and Renzo TVL on Binance have reached $3 billion each. Puffer Finance and Kelpdao are following closely with volumes of $1.27 billion and $760 million, respectively.

This means that the volume has grown nearly tenfold in the past four months. The restaking protocol itself, classified as Eigenlayer’s ecosystem, has reached $15.76 billion, nearly $16 billion. Why are so many ETH being staked in it?

AVS includes middle layers on the Ethereum network (such as oracles, cross-chain bridges, side chains, etc.), and non-EVM applications need to bear the cost (ETH) to operate nodes. Assets staked on EigenLayer for the second time can:

Reduce project operating costs

Maintain higher security

Therefore, with the current state of everything being on the chain, projects willing to attach to the Ethereum ecosystem have emerged one after another, further increasing the demand for ETH.

Currently, 9 AVS developed through Eigenlayer have gone live, and the observed seven-day growth data are all double-digit. EigenDA, the largest in volume, has even surpassed hundreds of node operators. It is mainly node operators participating, and there are fewer opportunities for retail investors, so many people have overlooked this market.

How much funds are there among these AVS? Lagrangedev, ranked fourth, already has $4 billion worth of ETH staked, surpassing Sei Network with $3.3 billion, Polygon with $2.6 billion, and others with $2.1 billion.

Let us further understand these nine AVS, including EigenDA, Eoracle, Witness Chain, Brevis, Omni Network, Altlayer, Xterio Games, Automata Network, etc.

Eigenlayer’s own data availability layer, such as the layer 2 launched by bitdao – Mantle, is based on the development of eigenDA. It allows authorized nodes to provide data availability services to the Mantle network, improving overall network performance. These nodes need to stake $MNT to maintain operation and achieve modular blockchain.

Further reading:

BitDAO Upgrades Brand to Mantle Network, $200 Million Ecological Fund Develops Layer 2 Ecosystem

Focusing on the oracle in the RWA sector, Renzo team pledged nearly 270,000 ETH to luganodes, which provides services to Eigen_DA and Eoracle_network. Owners of $ezETH can earn their own Renzo points and eoracle points. Do you understand what this means? In addition to restaking protocols, you can now also obtain AVS service points.

However, the big opportunities in the market often come from ambushes. If we believe that this bull market will continue, it is worth paying attention to a few AVS services. There are definitely good opportunities.

Renzo Twitter link

https://x.com/RenzoProtocol/status/1781475291778658513…

Witness Chain aims to convert unverified physical properties in the DePIN network into measurable and verifiable digital proofs through its coordination layer (DCL). These proofs can be further verified by different applications or the DePIN chain itself to establish new products and services. The benefits include:

Creating new services / building a basket of products

Improving resource utilization

Innovation and service improvement

Witness Chain has actually been in development for three years. The organization behind it is Kaleidoscope Blockchain, founded by Ranvir Rana. He has a good relationship with Eigen founder Sreeram Kannan, Polygon founder Sandeep Nailwal, and they all come from India.

Lagrange is a zk-based AVS that was launched on the Euclid testnet on April 17th. Its product is a ZK coprocessor and the first verifiable database on Ethereum. It uses efficient computation to build dApps with massive data in smart contracts. It includes low hardware requirements, support for cross-chain data trustless access, and low verification costs for AVS. This may revolutionize DeFi protocols. Lagrange Labs raised $4 million in May 2023, with 1KX leading the investment, and other investors include Maven11, Lattice Fund, CMT Digital, Daedalus Angels.

Similar to the previous one, Brevis provides coChain AVS that integrates cryptographic economic security and zero-knowledge proofs into one model for full-chain data proof. This new architecture can significantly reduce the cost of ZK coprocessing and enable dApp developers to explore possibilities that were not achievable with the “pure ZK” model before. It previously announced partnerships with Automata Network and Aperture Finance.

Potential use cases include:

Easy creation of VIP loyalty programs for DEX

On-chain liquidity management protocol triggered by user intent (specific on-chain states and events)

Multi-dimensional and zero-knowledge-based on-chain reputation, mainly in the field of DID

Interestingly, Brevis was actually developed by Celer Network. Brevis’ information was already announced in March 2023. The founder is Mo Dong, who has been deeply involved in the “cross-chain interoperability” field for a long time.

Tweet link:

https://x.com/CelerNetwork/status/1638330932603109379…

The most well-known may be Altlayer, the leader of RaaS (Rollup as a Service). It is also a project that I have been paying attention to since the bear market. Altlayer can be considered a tier 1 partner in the era of multiple chains. The team mentioned in a post on April 25th that it is currently the largest node operator in Eigenlayer’s ecosystem (7563 people).

Why do so many projects need to cooperate with Altlayer? Besides helping Xterio create a new layer 2, Altlayer also has Altlayer MACH AVS, which allows users to delegate assets such as ETH and LST (liquid staking token) $ALT to any node, providing fast finality for Rollup.

Another update worth noting is the collaboration with Polyhedra. AltLayer joins as a node operator for Polyhedra’s Bitcoin dual-staking AVS, ensuring transaction security through EigenLayer’s restaking mechanism.

Omni Network is doing something interesting, and its background should not be underestimated. It raised $18 million from Pantera Capital, Two Sigma Ventures, Jump Crypto, and Spartan Group. As their Twitter profile says, “The blockchain built to unite all rollups.”

Omni Network’s AVS – Omni Omega’s main selling point is cross-chain interoperability. It has launched The Open Liquidity Network project (partners currently include Sushiswap, Canto, and Flow). It enables tokens to circulate across various EVM chains through the xERC-20 standard, solving the problem of fragmented liquidity across chains. Key ecosystem protocols such as Puffer Finance, Story Protocol, Monad, Xion Network, Caldera, Elixir, and Movement are included in the airdrop.

XterioGames Mach is an AVS developed based on Altlayer. Currently, users can earn future $XTER tokens through the launch pool by staking $ALT.

Xterio is a project that I have previously introduced. Xterio itself is a one-stop web3 game distribution platform, founded by a team with rich gaming experience from EA Games, Activision Blizzard, FunPlus, Netease, and other gaming giants. For more details, please refer to my previous tweet.

https://x.com/Alvin0617/status/1732443309896060990…

Automata, based on Proof of Machinehood, is an AVS launched on April 26th. It also collaborates with Altlayer. Its initial partners are Linea and Scroll, two zkEVMs. They mention that the security and decentralization of most Rollups rely on a single prover and there is no good solution yet.

The Multi-Prover AVS can solve this problem by simplifying the process of secondary TEE (Trusted Execution Environment) verification in the protocol, providing services for zk modular infrastructure. Regarding the data of these AVSs.

The above is a comprehensive introduction to each AVS, and if you are interested, you can further explore them through the AVS browser developed by StakingRewards for the latest data.

AVS

EigenLayer

Further reading

Eigen Foundation pacifies the crowd: provides additional airdrops, announces the lifting of circulation restrictions on September 30th

EigenLayer increases ETH withdrawal requirements, and the market is digesting the airdrop expectations.