Analyst Willy Woo Foresees Bitcoin Bear Market Bottoming Out at $91,000

Bitcoin fundamental analyst Willy Woo predicts that as institutional funds fully embrace Bitcoin as part of their asset allocation, the future price range for Bitcoin will be $650,000 to $91,000.

Table of Contents

Toggle

Willy Woo: $91,000 will be the future bottom for Bitcoin

Bitcoin will experience its golden 12 years

Willy Woo: $91,000 will be the future bottom for Bitcoin

Willy Woo points out that traditional institutional asset management has a scale of about $100 trillion. According to Fidelity Investments, these institutions typically recommend allocating 2% of funds to Bitcoin. This means that as more institutions participate in Bitcoin ETFs, there will be a capital inflow of $2 trillion into Bitcoin.

The current value of Bitcoin spot ETF is approximately $56.1 billion BTC. If all institutional Bitcoin ETFs are fully deployed, the total amount will reach $2.56 trillion.

Next, applying the MVRV indicator, according to MacroMicro, the current MVRV is 2.32. It usually exceeds 5 at the top of a bull market and is around 0.7 at the bottom of a bear market.

Advertisement – Continue reading below

Based on this, the upper and lower limits of Bitcoin’s future market value are estimated to be $12.8 trillion and $1.8 trillion, or $650,000 and $91,000 per Bitcoin.

(Note: MVRV is commonly used to evaluate whether BTC is extremely overvalued compared to its fair value. The formula is “market value / realized value,” where realized value refers to the sum of average prices at the last on-chain transfer of all BTC.)

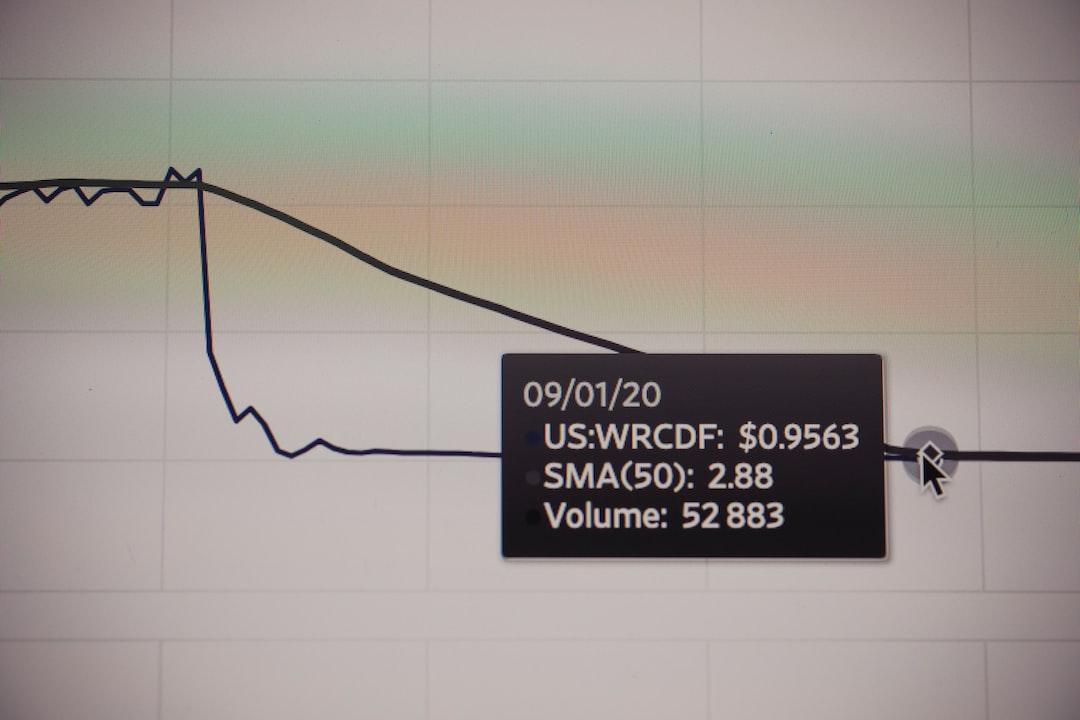

MVRV

Bitcoin will experience its golden 12 years

Willy Woo emphasizes that this rough estimate of the upper and lower limits does not include inflows outside of ETFs. Typically, self-custodied Bitcoin inflows are much larger than those of ETFs, so this estimate is conservative.

He also predicts:

When all ETF issuers are fully deployed, the market value of Bitcoin will definitely surpass that of gold. Gold experienced a 12-year bull market after the approval of spot ETFs, and now it’s Bitcoin’s turn.

However, Willy Woo concludes by stating that price targets are not for this current cycle, as fund deployment takes a long time to complete.

(Review: “Gold ETF” predicts Bitcoin’s trend, breaking historical highs in four years is not a dream)

bitcoin

BTC

Willy Woo

Fidelity

Bitcoin

Further reading

Matrixport: Nearly 20% of market positions liquidated, Bitcoin fails to demonstrate hedging characteristics

BingX celebrates the fourth Bitcoin halving and launches a 10 BTC prize pool.