Analysis by CryptoQuant: Bitcoin Faces Short-term Pullback Risk, Expected to Reach $160,000 by 2024

Bitcoin Shows Strong Performance in 2023, with an Increase of Over 180% Year-to-Date. Supported by a series of positive factors such as halving and the approval of a spot ETF, CryptoQuant predicts that BTC faces short-term correction risks but could potentially surge to $160,000 in the next cycle.

Contents:

Toggle

BTC Targets $160,000

Caution for Short-Term Correction in BTC

BTC Targets $160,000

Crypto analysis firm CryptoQuant, in a report shared with CoinDesk, indicates that the positive factors for Bitcoin will drive mid-term targets of $50,000. These positive factors include:

Market valuation cycle

Recovery of on-chain activities

Block reward halving

Macro-economic outlook

Approval of Bitcoin spot ETF

Continued growth of stablecoin liquidity

CryptoQuant suggests that the mid-term target could be $54,000, with a cycle high of $160,000.

Advertisement – Continuation of the content, please scroll down

Caution for Short-Term Correction in BTC

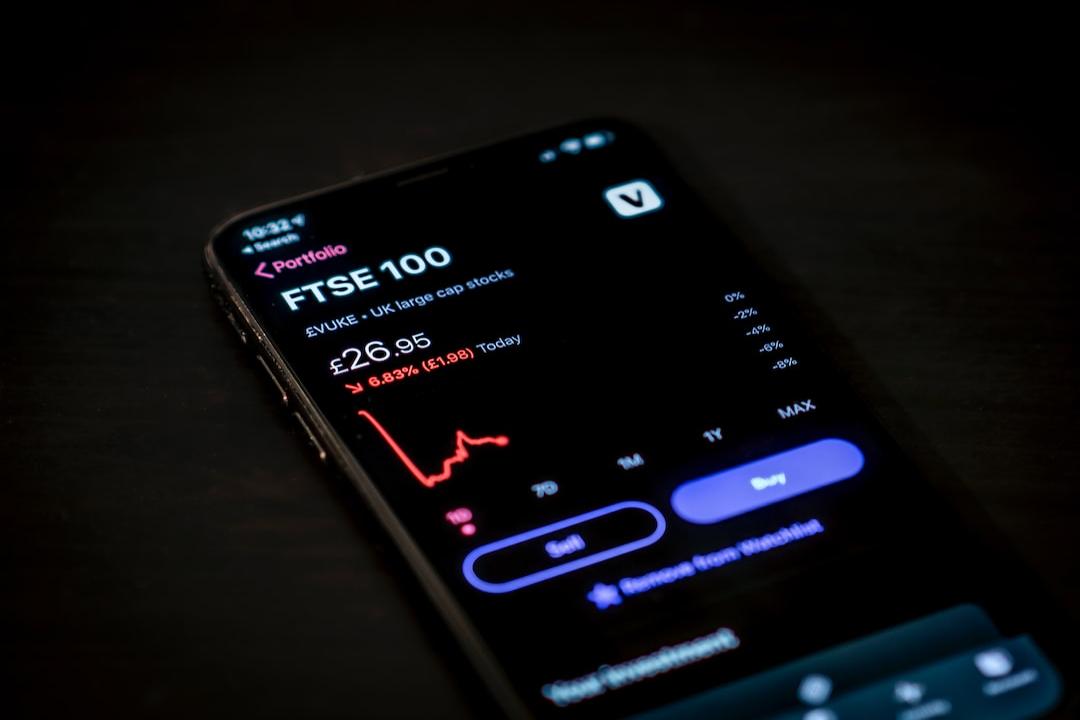

CryptoQuant also warns in the report that due to the presence of unrealized profits among short-term investors, there is still a risk of price correction in the short term.

Analysts say:

Given that short-term Bitcoin holders are experiencing higher unrealized returns, historically, this situation often occurs before a price correction, indicating that there is some risk of price adjustment for Bitcoin.

BTC

CryptoQuant

Bitcoin spot ETF

Related Reading

Phantom Wallet Adds Support for Bitcoin Network, Users Can Purchase BRC-20, Ordinals

Arthur Hayes: “Made in the USA” is Also Important for Bitcoin Spot ETF, Who Can Buy and Sell Bitcoin is Key