The Reasons for the Absence of Altcoin Season Decentralization and Its Hidden Threat to the Cryptocurrency Market

A significant flaw is emerging in the cryptocurrency market, threatening the stability and growth of the crypto market. According to cryptocurrency analyst Miles Deutscher, the problem is the underperformance of altcoins in the current cycle, and there doesn’t seem to be an immediate solution.

Understanding the Cycle: The Rise and Fall of Bull Markets

2021: The Market Frenzy

The Role of Venture Capitalists

Explosive Growth of Cryptocurrencies

Unprecedented Influx of New Tokens

Token Dilution: Persistent Inflation

Supply Pressure and Market Impact

High FDV and Low Circulation Create Issues

Solutions and the Path Forward

Need for More Liquidity

Improvement Measures

Role of Exchanges

Conclusion

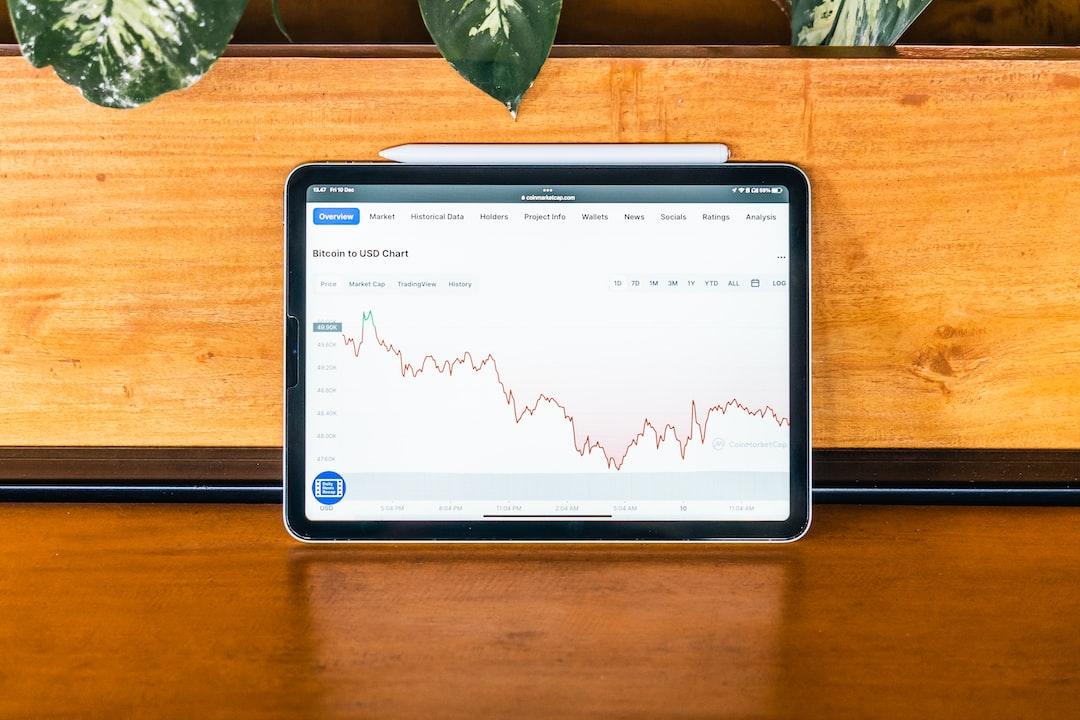

Miles Deutscher noted that the highlight of the 2021 cryptocurrency market was the “influx of new liquidity,” primarily driven by retail investors outside the crypto circle. The bull market at the time seemed unstoppable, and investors were willing to take risks. Venture capitalists (VC) also poured an unprecedented amount of funds into startups and tokens, creating a prosperous environment.

Stablecoin Issuance Soars

(Aggregate of 300 global crypto VCs managing $83.9 billion in crypto VC industry in 2023)

Miles Deutscher’s statistics show that venture capitalists made early investments at lower valuations in the 6 months to 2 years before project initiation. This investment provided funding for project development and offered additional services and networks. Interestingly, the first quarter of 2022 was the peak period for venture capital funding, reaching $12 billion, coinciding with the beginning of the bear market.

VC Investment Peaks, Prices Start to Decline

Miles Deutscher pointed out that the combination of low barriers and high return potential during the bull market led to a massive increase in new tokens. The total number of cryptocurrencies tripled from 2021 to 2022. However, the subsequent market downturn, along with events like the collapse of LUNA and FTX, caused many projects to delay their releases, waiting for better market conditions.

By the fourth quarter of 2023, improved market conditions led to a record number of new token releases in 2024. Since April, over 1 million new cryptocurrencies have been released, with a large portion on the Solana network being meme coins.

Miles Deutscher stated that the influx of new tokens has created significant supply pressure in the market, estimated at approximately $150-200 million in new supply pressure per day. This constant selling pressure has a similar impact on the market as traditional currency inflation.

Many new tokens were released with low fully diluted valuation (FDV) and high circulation mechanisms, leading to persistent supply pressure and dispersion. As a result, the market faces dilemmas of dilution and insufficient new liquidity.

Miles Deutscher used the term “dispersion” instead of “distributed” to emphasize that the tokens had a large circulation from the start, dispersed among all investors in need, and as the supply continued to grow, they faced a shortage of demand, an oversupply situation.

To address this issue, Miles Deutscher believes that the cryptocurrency market needs more liquidity. However, the current trend of leaning towards the private market is causing harm and making retail investors feel deprived.

Several measures can help alleviate the problem:

Exchanges strengthening token distribution management.

Projects prioritizing community distribution and providing larger pools for genuine users.

Implementing a tiered selling tax to prevent dumping.

These solutions have been discussed in the past. He believes that even if industry insiders do not enforce change, the market will eventually force change. The market always self-corrects and adjusts.

Most current problems are short-sighted. The market needs to give retail investors a reason to return, which at least solves half the problem.

He believes that exchanges need to be more pragmatic, balancing new listings and delistings to clear out defunct projects and release valuable liquidity.

The dispersion of altcoins is a major challenge in the cryptocurrency market. Addressing this issue requires a market friendly to retail investors and pragmatic measures from exchanges and projects. While the problem is complex, the market may self-correct over time. Creating a more balanced and sustainable ecosystem will benefit all stakeholders, from projects and venture capitalists to exchanges and retail investors.

Altcoin

Miles Deutscher

Token Economy

Altcoins

Related Reading

SEC Pressure! Bitstamp, a Veteran Exchange, Delists Some Coins, Seeks Financing for Expansion

Celsius Starts Dumping! Transfers Over $66 Million in Altcoins, Sells Crypto Custody Platform