Kaiko Analysis: Sharp Decline of Bitcoin ETF Listing, Exacerbated by Binance, OKEx, and Upbit Dumping

Contents

Toggle

Bitcoin Spot ETF passes and plummets

Binance, OKEx, Upbit face selling pressure

Bitcoin Spot ETF passes and plummets

Bitcoin celebrated the first listing of its Spot ETF on January 11th. Although it briefly soared to $48,988 after the US market opened, it closed at $45,569 on the same day and dropped further to $41,360 on the 12th.

(

Bitcoin Spot ETF officially listed, BTC plummets, ETH follows suit

)

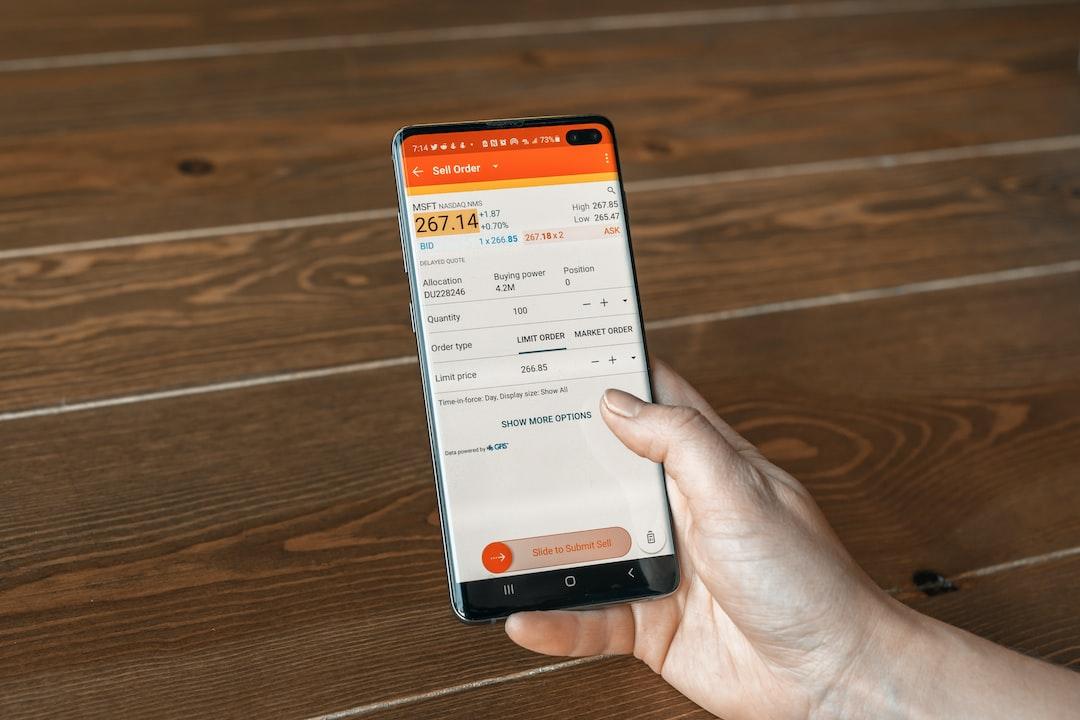

BTC 1H Chart|Source: OKEx

Binance, OKEx, Upbit face selling pressure

Kaiko

In its report, it pointed out that after the ETF started trading, the cumulative volume delta (CVD) of all major exchanges surged significantly, with Binance and OKEx’s CVD quickly falling into negative territory.

Advertisement – Continue scrolling for more content

Although Upbit had lower trading volume, it still showed continuous selling with little retracement.

However, Coinbase and Bitstamp maintained positive CVD values.

Note: CVD tracks the net difference between buying and selling volume over time, providing data on overall bullish/bearish pressure in the market. Positive values indicate greater buying pressure, while negative values indicate greater selling pressure.

Exchange CVD changes

Looking at the performance of Bitcoin’s Spot ETF in the past week, it seems to be more of a “sell the news” event.

OKEx

Upbit

Binance

Further reading

TUSD decoupling, issues with Poloniex withdrawals? What happened to Justin Sun’s TUSD?

Regulatory concerns? Binance adds monitoring labels for ZEC, XMR, and other privacy coins.