14 Consecutive Days of Net Inflows Global Bitcoin ETF Holdings Surpass One Million Coins Accounting for Nearly 5 of Circulation

Content

Toggle

Global Bitcoin ETF holdings exceed one million BTC

Bitcoin spot ETF has been net inflow for 14 consecutive days

ETF holdings far exceed those of listed companies

According to statistics from @HODL15Capital, the total value of Bitcoin held by global Bitcoin spot ETFs has reached 1,005,767 BTC, with a total value of over 68 billion US dollars (the US accounts for 581 billion US dollars), accounting for 4.78% of the total circulation, setting a new historical high.

Among them, BlackRock holds 291,568 BTC, ranking first, surpassing Grayscale, which previously held the top spot with 285,126 BTC.

(

BlackRock IBIT Bitcoin assets officially surpass Grayscale GBTC

)

Advertisement – Scroll down for more

Global Bitcoin ETF holdings

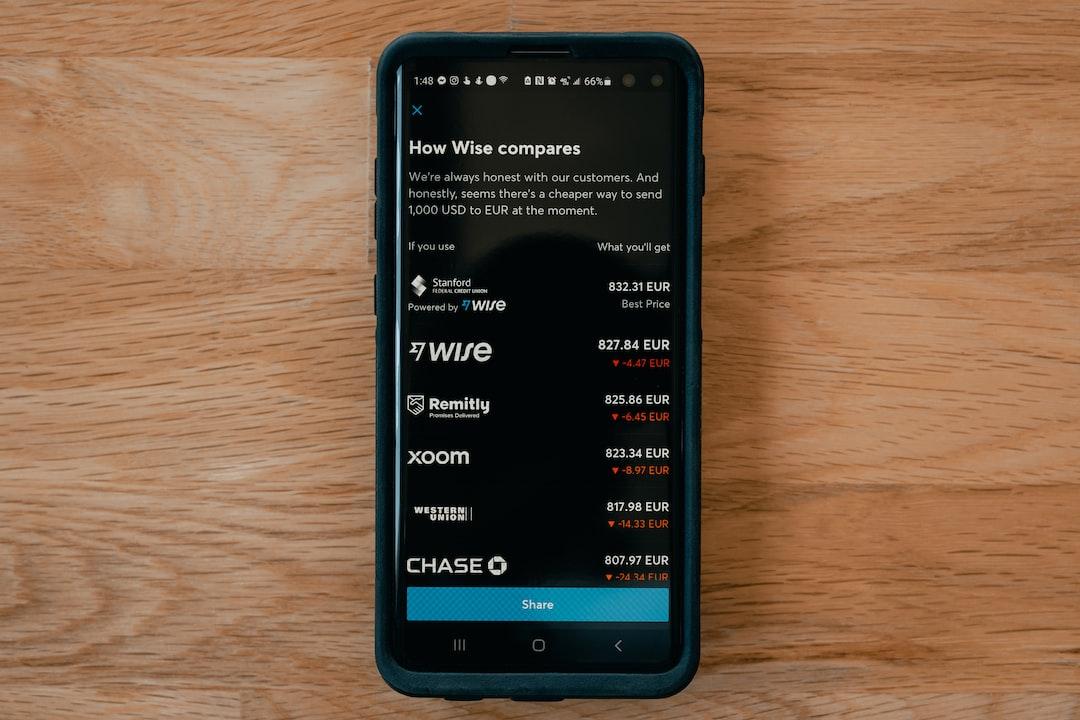

Bitcoin spot ETF has been net inflow for 14 consecutive days

Meanwhile

SoSo Value

data shows that Bitcoin spot ETF has been net inflow for 14 consecutive days.

Grayscale (GBTC) has also had net inflows for several days:

5/3: $63.01 million

5/6: $3.94 million

5/15: $27.05 million

5/16: $4.64 million

5/17: $31.61 million

5/20: $9.35 million

(

On 5/15, Bitcoin ETF had at least $300 million in net inflows, while GBTC saw $27 million entering the market again

)

ETF net inflow data

ETF holdings far exceed those of listed companies

After the official approval of Bitcoin spot ETF in the United States in January this year, the global Bitcoin spot ETF scale immediately far exceeded the Bitcoin holdings of listed companies.

According to BitcoinTreasuries, the global Bitcoin holdings of listed companies are approximately 307,795 BTC, accounting for 1.47% of the total circulation.

Just MicroStrategy alone holds 214,400 BTC, accounting for 1.021% of the total circulation.

(

MicroStrategy’s BTC holdings reach 1% of total circulation, Canaccord Securities lowers target price

)

Listed company holdings

Similar to the previous bull market, there are also listed companies that emulate MicroStrategy, including medical technology company Semler Scientific and Japanese company Metaplanet.

After buying 117.7 BTC, Metaplanet’s stock price briefly increased sixfold, and CEO Simon Gerovich emphasized in a mid-May interview that they will continue to buy Bitcoin.

(

Joining the ranks of MicroStrategy! Medical company Semler Scientific announces purchase of Bitcoin

)

GBTC

IBIT

MicroStrategy

Bitcoin spot ETF

Grayscale

BlackRock

Related reading

Net inflow of 1 Bitcoin? Australian Bitcoin spot ETF “IBTC” had a dismal debut on the first day of listing

Bitcoin spot ETF continues to see net inflows, with a bold prediction of 10x, BTC will hit a new historical high next week